Get Fresh Mortgage Brokers Email List 2025

Looking for a reliable mortgage brokers email list in 2025? You can buy one or build your own. This guide covers both options. We’ll compare vendors, show where to find licensed brokers online, and walk through building your own segmented list with an email scraper like IGLeads. You’ll learn how to filter by region, company size, or specialization, export to CSV, and keep your outreach compliant while reaching the right decision-makers in lending and finance.

Top 5 ways to get fresh mortgage broker email lists

If you’re targeting mortgage brokers in 2025, the quality of your email list can make or break your campaign. The best-performing lists are accurate, segmented, and sourced from reliable channels. Here are five proven methods to build or acquire a list that actually delivers results:

1. Use mortgage license directories and public databases

Every licensed mortgage broker in the U.S. must register with state or federal agencies, and many of those records are public. For example, the NMLS Consumer Access portal offers verified broker profiles, including licensing status and business affiliations.

Here’s how to get the most out of public databases:

- Filter brokers by state, license type, or company

- Cross-reference listings with LinkedIn or Google Maps

- Scrape contact info using automation tools (where permitted)

- Verify contact accuracy through manual lookup or enrichment

- These databases are especially helpful for state-specific campaigns or compliance-sensitive industries.

2. Leverage LinkedIn to connect with brokers directly

LinkedIn remains one of the most underused resources for mortgage industry outreach. You can search for titles like “Mortgage Broker,” “Loan Officer,” or “Mortgage Advisor” and filter by region, company, or experience level.

Here’s how to use LinkedIn effectively:

- Use Sales Navigator for better filters

- Join mortgage and real estate groups for warm entry points

- Engage with posts to build rapport before pitching

- Export public email addresses (when visible)

- Use email enrichment tools for additional contact details

LinkedIn-based outreach often yields higher response rates, especially when paired with warm, personalized messaging.

3. Scrape broker emails using tools like IGLeads.io

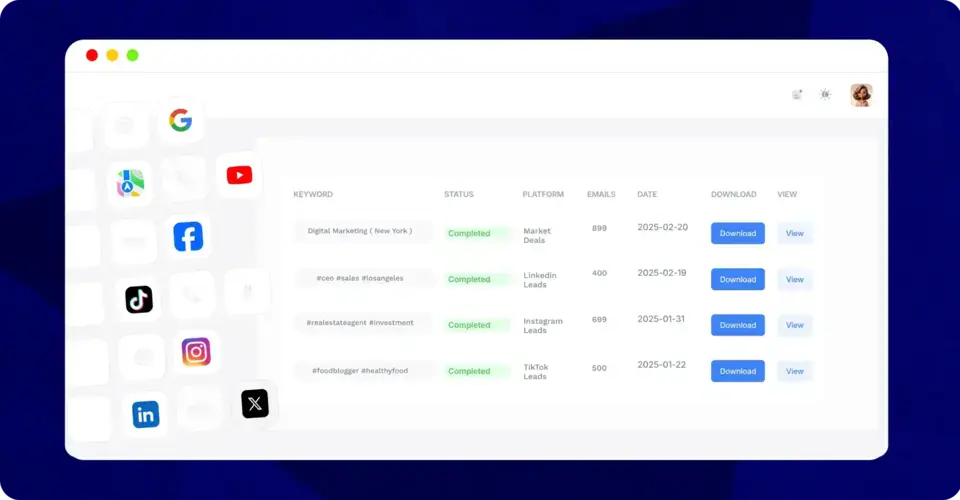

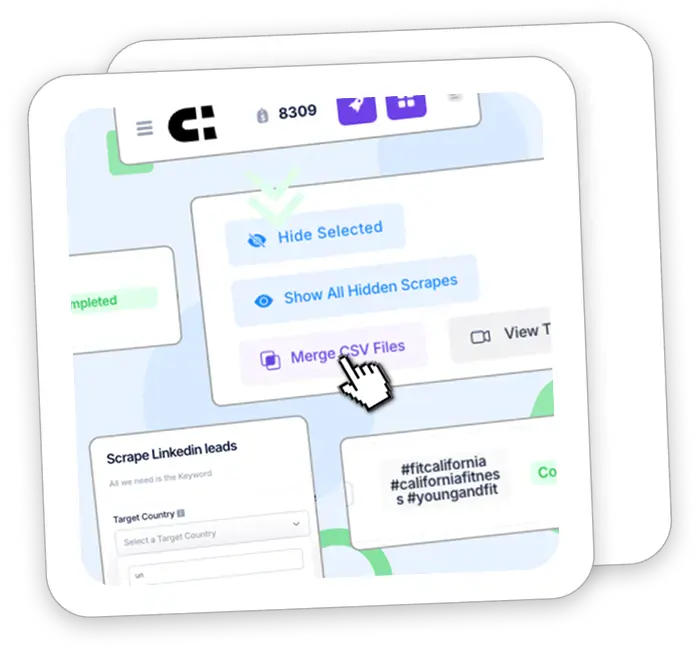

Manual scraping takes forever. Automated tools like IGLeads.io simplify the process and help you gather large batches of accurate contact data from social platforms and business directories.

With IGLeads, you can filter by:

- Job title (e.g., “mortgage broker”)

- Location (city, state, or nationwide)

- Platform (LinkedIn, Google Maps, etc.)

The platform delivers clean CSV files that are ready to import into your CRM or email tool. Depending on your filters, you can generate hundreds or thousands of broker contacts in a few hours.

4. Tap into mortgage associations and local chapters

Professional associations like the National Association of Mortgage Brokers (NAMB) and various state-level groups maintain up-to-date member directories. These are goldmines for niche targeting, as members are often vetted and actively involved in the industry.

You can:

- Access member contact info via association websites

- Sponsor events or webinars for lead capture

- Request inclusion in member resource emails

- Network with brokers at trade shows or expos

This method works especially well for B2B brands offering compliance tools, training, or software solutions tailored to brokers.

5. Purchase from verified list providers

Reputable B2B data providers offer pre-built or custom-filtered lists of licensed mortgage brokers. These lists often come enriched with job titles, contact emails, phone numbers, and company details, and most vendors offer deliverability guarantees.

Trusted providers like BookYourData or Salesfully typically include:

- Filtering options (by geography, specialty, or license type)

- Regular updates to maintain accuracy

- Compliance with email marketing laws

- Free replacements for undeliverable contacts

This method is ideal if you need volume fast, but always vet the provider and ask for sample data.

Each of these five methods has its own strengths. Depending on your goals, budget, and timeline, you can combine manual methods (like LinkedIn and public records) with automation or verified purchases to create a hybrid list that fits your exact needs.

Benefits of targeting verified mortgage broker email addresses

Reaching mortgage brokers through a verified email list gives you a serious advantage in a competitive industry. These professionals control access to key financial products, home loans, refinancing, and commercial mortgages, making them high-value contacts for companies offering lending software, CRM systems, financial services, insurance, and more.

The top benefit of a verified list? Accuracy. You’re not just emailing random inboxes, you’re connecting with active brokers who are currently working in the field. This leads to dramatically lower bounce rates, better engagement, and stronger sender reputation.

Verified mortgage brokers email lists also open the door to precise targeting, letting you segment by:

- Geographic region (state, city, zip code)

- Loan types (residential, commercial, FHA, VA)

- Broker type (independent, firm-affiliated, licensed loan officers)

- Volume of loans or years in business

With this level of segmentation, your outreach becomes more personalized and persuasive, for example, promoting a lead tracking tool to brokers handling high-volume FHA loans in Florida, versus a CRM demo for boutique mortgage firms in California.

Email marketing already delivers an average ROI of $40 per dollar spent. When paired with a clean, verified email list, that ROI climbs even higher, especially in real estate, where customer value is high and timing is critical.

You can also repurpose the data for multi-channel campaigns. Use it for LinkedIn outreach, phone prospecting, retargeting ads, or event invites. And because verified contacts meet compliance standards like CAN-SPAM and GDPR, you stay legally safe while expanding your reach.

A mortgage broker email list isn’t just a lead source, it’s a strategic asset. It fuels outbound campaigns, increases lead quality, and saves time you’d otherwise spend chasing dead ends. In short: it helps you reach the right lenders, at the right time, with the right offer.

Perfect — thanks for dropping that section. Right now it’s solid tactical advice, but it never ties back to IGLeads, which makes it feel generic.

I’ll reframe it so each use case shows how having a fresh, segmented list from an email scraper like IGLeads directly enables the strategy.

How to Use a Mortgage Brokers Email List for Marketing

Once you’ve secured a quality mortgage broker email list, the next step is to turn those contacts into business results. Whether you’re offering software, financial services, training programs, or B2B solutions, a segmented and up-to-date list is what makes email campaigns work. Here’s how marketers use IGLeads-powered lists in 2025:

1. Promote financial tools and lending software

Mortgage brokers need solutions that help them close loans faster, stay compliant, and manage clients efficiently.

- With traditional lists: You’re often stuck with generic contacts that may not even be active.

- With IGLeads: You can scrape and filter for brokers by region, company size, or loan type specialization. That lets you send campaigns tailored to the right segments, for example, targeting FHA loan specialists with compliance software, or jumbo loan brokers with advanced quoting tools.

Pair the list with case studies or free trial offers to maximize response.

2. Send invites to webinars and live events

Brokers thrive on networking and industry education. Webinars and training events are a proven way to build trust.

- With traditional lists: You might waste budget inviting inactive or irrelevant contacts.

- With IGLeads: Since data is pulled in real time from public sources, you’re more likely to hit active brokers currently working in the field. That means higher open rates and better attendance when you send “save the date” and reminder emails.

You can even segment invites by location to promote in-person events regionally.

3. Share industry insights and mortgage trends

Email newsletters are a low-cost way to stay top-of-mind. Brokers want quick, useful updates on lending rates, regulations, and productivity tools.

- With traditional lists: Engagement drops if your newsletter lands in outdated inboxes.

- With IGLeads: You’re starting with fresher contacts, people who have recently updated their profiles or business info. That gives your insights a better chance of reaching real decision-makers who care about market shifts.

A monthly cadence works well, with bonus sends for major housing or lending updates.

Build Your Mortgage Broker Email List the Smart Way

Did we convince you that using IGLeads to build mortgage broker email lists is worth trying? With IGLeads, you don’t need coding skills or technical setups. Just set your filters, click “Start,” and export fresh, accurate contacts in minutes. Sign up today and start reaching real brokers and lenders faster.

Related to Real Estate

- Get Fresh Real Estate Email List 2025

- Get Fresh Real Estate Agents Email List 2025

- 15 Best Real Estate Lead Generation Software for 2025

- Email Extractor Ultimate Guide 2025

- How to Get a Homeowner Mailing List in 2025?

- Realtor Email List 2025

Frequently Asked Questions

A mortgage broker email list is a database of verified contact details for licensed mortgage professionals. It usually includes names, email addresses, locations, and in some cases, specialties or company affiliations. Marketers and B2B vendors use these lists to promote financial services, software tools, and industry events.

Yes, but only if the list is compliant with regulations like CAN-SPAM, GDPR, or CASL. You must ensure the data comes from public sources or opt-in directories. All emails should include proper sender info, truthful subject lines, and an easy unsubscribe option to stay within the law.

That depends on the provider. High-quality lists updated monthly can hit 90–95% deliverability rates. Look for vendors that offer email validation, bounce protection, and filtering by license status or geography. Some also provide free replacements for invalid contacts.

You can build your own list using public directories (like NMLS), LinkedIn, or tools like IGLeads.io. Scraping from verified sources and combining that with manual research lets you create a highly targeted list based on loan type, location, or firm size. Just ensure compliance with data laws.

A mortgage broker works as an intermediary between borrowers and lenders, while lenders are the institutions that actually provide the loan. A broker list targets professionals who source deals and advise clients, while a lender list focuses on institutions that issue funds. Your outreach strategy should match the role you’re targeting.