Get Fresh Insurance Agents Email List 2025

Looking for a reliable insurance agents email list in 2025? You can buy one or build your own. This guide covers both options. We’ll compare vendors, show you where to find licensed agents online, and explain how to create a targeted list with an email scraper like IGLeads. You’ll see how to filter by license type, product specialty, location, or agency size, export to CSV, and keep your outreach compliant while connecting with real insurance professionals.

Top 5 ways to get fresh insurance agent email lists

Getting your hands on a high-performing insurance agents email list doesn’t require guesswork. Whether you’re targeting brokers in California or life insurance reps nationwide, here are five proven ways to build or acquire accurate, up-to-date contact data that actually gets results.

1. Use state insurance license lookup tools

Each U.S. state maintains a licensing board for insurance agents and brokers. Many of these offer searchable online directories that include:

- Full names and license numbers

- Business addresses and agency info

- License type and status (active/inactive)

While email addresses aren’t always public, these directories are excellent for verifying agents before enriching them with contact data using a tool like IGLeads.

2. Tap into LinkedIn’s advanced search

LinkedIn is packed with licensed insurance professionals. Using job titles like “insurance broker,” “licensed agent,” or “Medicare specialist,” you can find targeted segments filtered by:

- Location

- Company

- Industry

- Years of experience

Once connected, you can often view their email addresses or use scraping tools to extract that data at scale, ethically and efficiently.

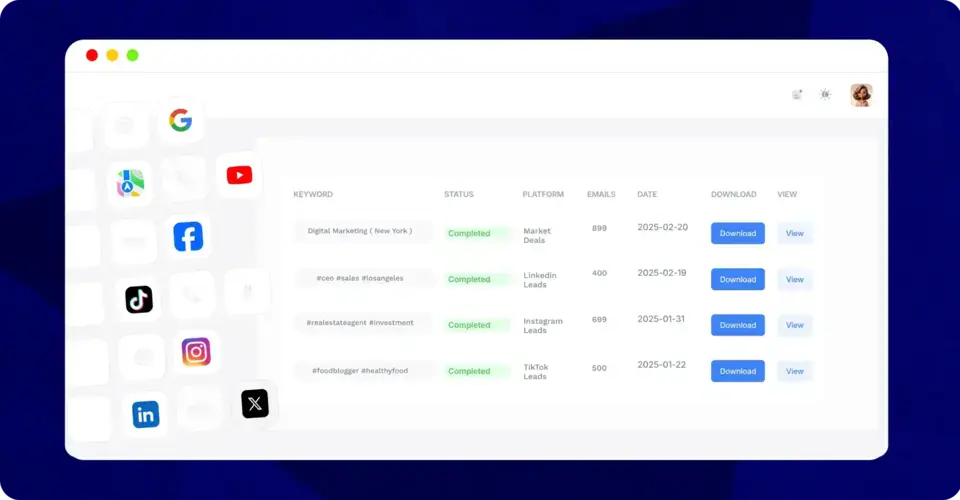

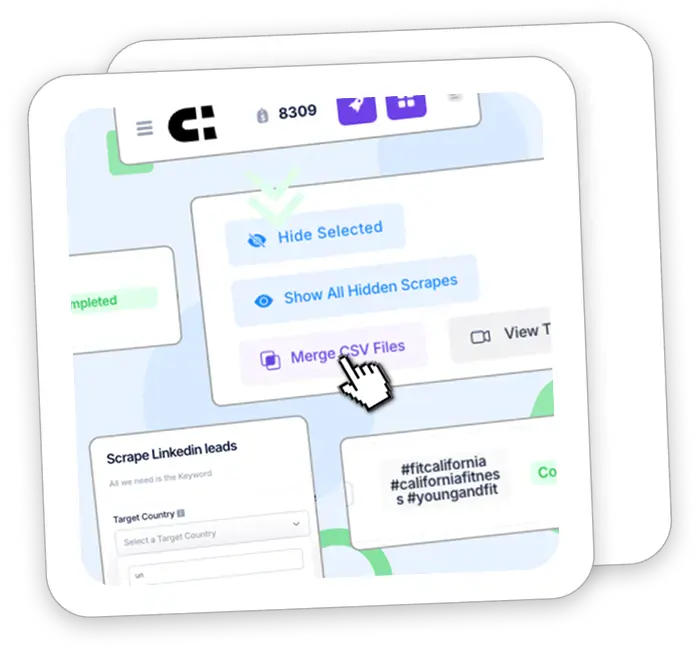

3. Scrape live data with IGLeads.io

If you need hundreds or thousands of fresh insurance agent contacts fast, automation is the answer. IGLeads.io lets you:

- Scrape emails from LinkedIn by job title and location

- Pull agent data from local listings on Google Maps

- Export CSVs ready for upload to your CRM or outreach tool

Unlike static databases, this method ensures you’re working with real-time, publicly visible information. It’s perfect for high-volume prospecting campaigns.

4. Buy from verified B2B data providers

Some lead gen services offer pre-vetted email lists for specific industries — including insurance. These providers typically allow filtering by:

- Insurance specialty

- Geography

- Business size or revenue

- Seniority level

Just make sure you choose vendors with transparent sourcing and strong delivery guarantees (95%+). Always ask about compliance, update frequency, and refund policies before purchasing.

5. Attend or scrape data from insurance events

Webinars, conferences, and virtual summits are filled with active agents and decision-makers. Some platforms publish attendee lists or directories, which you can extract and enrich using a scraper or email finder tool. Bonus: these contacts are already in a business mindset, which increases engagement rates.

Benefits of targeting verified insurance agent emails

A verified insurance agent email list gives you something most marketing teams lack: precision. You’re not guessing who your audience is, you’re speaking directly to professionals who influence high-value decisions in real time.

1. Higher deliverability, better results

Clean data means your emails land in active inboxes, not dead ends. With verified emails, you can expect:

- 95–98% deliverability rates

- Lower bounce rates

- Fewer spam issues and stronger sender reputation

That translates directly to better open rates and more engagement, especially for outbound campaigns.

2. Smarter targeting that actually converts

Segmentation is where email marketing shines. With a clean list, you can filter by:

- Insurance type (health, life, auto, commercial)

- Location (state, region, ZIP)

- License level or years of experience

This makes your messaging more relevant, and relevance is what gets clicks.

3. Agents are eager buyers

Insurance professionals are constantly looking for tools that help them:

- Close more deals

- Stay compliant

- Improve client experience

- Generate new leads

That makes them ideal targets for CRMs, marketing automation tools, quoting platforms, training courses, and more.

4. Multi-channel potential

Your list isn’t just for email. Verified contact data can also be used for:

- Retargeting ads

- Phone outreach

- Direct mail campaigns

- Lookalike audience building

Clean data gives you flexibility across every marketing channel.

5. Legal peace of mind

Lists built through ethical sourcing and verification help you stay compliant with CAN-SPAM, GDPR, and other privacy laws. That means fewer risks, and fewer headaches.

What to Check Before Buying an Insurance Agents Mailing List (and How IGLeads Fits In)

Insurance is a highly regulated industry, and a bad email list can do more harm than good. Before you buy, here are the key factors to evaluate, and how IGLeads compares.

1. Is the data fresh and regularly updated?

Agent turnover is constant, many switch firms, licenses, or states every year. Old data = high bounce rates.

- Traditional vendors: Premium providers often refresh monthly and promise 90–95% deliverability with manual verification.

- IGLeads: Instead of waiting for quarterly refresh cycles, our email scraper pulls insurance agent contacts in real time from public sources like directories, LinkedIn, and agency websites. Your data is as current as the agent’s last update.

2. Can you filter by specialty, location, or license type?

Not all insurance agents are the same.

- Traditional vendors: Filtering depends on how their database is structured, often limited to broad categories.

- IGLeads: You build the filters yourself. Target by insurance type (health, life, commercial, auto), state or ZIP code, license type, agency size, or even keywords like “independent broker.” That way, your outreach goes to the exact agents most relevant to your offer.

3. What’s the deliverability rate?

Deliverability is where many marketers get burned.

- Traditional vendors: Some guarantee 95%+ inbox placement and replace undeliverable emails.

- IGLeads: Because our data is scraped live, deliverability won’t match hand-verified lists. But the trade-off is recency and scale, you can generate larger lists of active agents and run them through a verification tool to clean them before sending.

4. Is the list compliant with privacy laws?

Compliance is critical when targeting licensed professionals.

- Traditional vendors: Some advertise opt-in lists and provide compliance docs.

- IGLeads: We scrape only publicly available data. That means sourcing is clean, but you’re responsible for compliant sending, include opt-outs, use accurate sender info, and follow CAN-SPAM, GDPR, or state-level rules.

How to use an insurance agent email list for marketing

Once you have a high-quality insurance agent email list, the real work begins. Execution matters just as much as the list itself — and when done right, email marketing can become your highest-converting channel for reaching this high-value professional group.

Educate, then sell

Insurance agents are busy professionals who are bombarded with pitches. The best way to stand out is by offering value before making an ask.

Focus your early outreach on content like:

- Case studies from agents who use your tool or service

- Industry reports or insights on closing more deals

- Tips for managing compliance or client retention

- Short videos or PDFs that solve one clear problem

This builds trust and positions you as a helpful expert, not just another vendor.

Use smart segmentation

Tailor your campaigns to fit each agent’s role or focus area. With a segmented list, you can:

- Promote digital quoting tools to auto insurance agents

- Offer compliance software to life insurance brokers

- Send local networking invites based on ZIP code

- One-size-fits-all emails get ignored. Segmentation leads to higher open and click-through rates.

Don’t just email — layer your outreach

A verified list opens the door to multiple channels, not just inboxes. You can boost engagement by repurposing the same contact list across:

- LinkedIn ads targeting those same agents

- Retargeting campaigns based on opens or clicks

- Direct mail follow-ups to high-interest contacts

- Personalized voicemail drops or SMS follow-ups (where compliant)

The best-performing campaigns hit inboxes from multiple angles.

Optimize your messaging for response

Insurance agents are results-driven. Your messaging should focus on outcomes, not just features.

Instead of “Our CRM has powerful automation,” try:

“Agents using our CRM close 32% more policies per month — without hiring an assistant.”

Keep subject lines specific. Keep CTAs action-focused. And always send a second follow-up — many replies come after email #2.

Build Your Insurance Agents Mailing List the Smart Way

Did we convince you that using IGLeads to build insurance agent email lists is worth trying? With IGLeads, you don’t need coding skills or technical setups. Just set your filters, click “Start,” and export fresh, accurate agent contacts in minutes. Sign up today and start reaching real insurance professionals faster.

Find insurance leads and contact lists

- Best Life Insurance Lead Generation Companies 2025

- Email Extractor Ultimate Guide 2025

- Best Insurance Leads Companies in 2025

Explore more lead generation strategies and tools

- B2B Lead Generation Solutions – Guide for 2025

- How to Build a High-Quality B2B Email List for Outbound Marketing

- Buy Email Lists for Marketing in 2025: Complete Guide to Business Leads

- Why Scrape Google Maps? Use Cases for Sales, Marketing & SEO

- B2C Lead Generation: The 2025 Playbook

- 15 Best Lead Generation Companies for 2025

- Best B2B email list providers in 2025

- Top Lead Generation Agencies Compared (2025)

- 18 Best B2B Lead Generation softwares in 2025

- Lead Generation Guide: Strategies & Tools for 2025

Frequently Asked Questions

Our list includes a wide range of professionals, life insurance agents, property and casualty brokers, health insurance reps, and independent advisors. You can filter contacts by specialization, region, agency size, and more.

We extract contact data using ethical scraping from public platforms like LinkedIn and Google Maps, then cross-check it using real-time validation tools. This ensures high deliverability and accuracy.

Yes. Our email lists are designed for compliant outbound marketing. As long as you follow relevant email laws like CAN-SPAM, GDPR, and include opt-out links, cold outreach is allowed.

We update our scraping sources continuously and validate email deliverability regularly. This helps you avoid bounced emails and reach agents actively working in the field.

You’ll receive a downloadable CSV or Excel file with key fields like full name, email address, agency name, location, and job title—ready to plug into your CRM or email software.