How to Perfect Your Go-to-Market Strategy: Expert Tips That Drive Results

Four out of every five product launches fail. That’s not a typo.

A go-to-market strategy isn’t another buzzword floating around conference rooms—it’s the blueprint that determines whether your product succeeds or joins the 80% graveyard. Without one, companies burn cash on assumptions, build products nobody wants, and wonder why their “game-changing” solution gets ignored.

The difference between winning and losing often comes down to having a solid go-to-market strategy that actually works. The right GTM approach helps you understand your customers and competitors, streamlines your launch process, and gets you to market faster with better results.

But here’s what separates winning GTM strategies from the fluff: they tackle the hard questions upfront. Who exactly are you selling to? What makes you different enough to matter? How will you reach customers and convince them to buy?

We’ll walk you through each piece of building a GTM strategy that drives real results. Whether you’re launching your first product or expanding into new territory, these insights will help you avoid the expensive mistakes that sink most launches before they start.

What is a Go-to-Market Strategy?

A go-to-market strategy is your detailed action plan for bringing products to customers and winning in the market. It’s not a general business plan—it’s laser-focused on specific launches, market expansions, or repositioning efforts.

The best GTM strategies answer four core questions:

- What product are you selling and what unique problem does it solve?

- Who is your ideal customer and what pain points do they experience?

- Where will you sell your product and what does the competition look like?

- How will you reach target customers and create demand?

Here’s where most founders get confused: GTM strategy isn’t the same as marketing strategy. Marketing strategy is your long-term, company-wide approach. GTM strategy is short-term and product-specific. Think of marketing as your overall business roadmap, while GTM is your tactical plan for each specific launch.

When you need a GTM strategy

You absolutely need a fresh GTM strategy in three situations:

- Launching a new product in an existing market

- Bringing an existing product to a new market

- Testing a new product in a new market

Even successful companies with proven track records need new GTM strategies for each launch. Market conditions shift fast, and what worked six months ago might not work today.

Core components that matter

Effective go-to-market strategies include these critical pieces:

Market analysis: Market size, growth potential, and customer behavior insights Target customer definition: Clear profiles of ideal customers and their buying patterns Value proposition: Compelling statement of your product’s unique benefit Competitive analysis: Understanding competitors’ strengths and weak spots Pricing strategy: Your approach considering costs, market conditions, and competition Distribution plan: How your product actually reaches customers Marketing and promotion: Campaigns designed to generate interest and drive sales

A solid GTM strategy brings together product, marketing, sales, and customer intelligence teams around a single, aligned approach. This cross-functional alignment creates a shared roadmap that everyone can execute against.

Why it matters before you launch

Building your GTM strategy before launch reduces the risk of expensive market failures. It prevents you from wasting resources on products with weak demand and helps you position correctly against competitors from day one.

For startups, GTM strategy is especially critical. Early on, your go-to-market and marketing strategies might be identical—you’re just trying to get your first product to market. As you grow, these evolve into separate strategies with different teams and objectives.

The goal isn’t just getting your product out there—it’s accelerating market adoption. When you understand your ideal customer profile, competitive positioning, and market dynamics, you build a foundation that maximizes your chances of success.

Companies that invest time in comprehensive GTM strategies consistently outperform those that rush to market without proper planning. They avoid the costly mistake of assuming market demand and building products nobody wants.

Step 1: Define Your Target Market

Image Source: CleverTap

You can’t sell to everyone. Trying to target “all businesses” or “anyone who needs our solution” is the fastest way to waste money and confuse your message.

Segment by firmographics or demographics

B2B companies need to think in firmographics — grouping prospects by company characteristics rather than personal details. Companies with similar traits usually face similar problems and buy in similar ways.

Focus on these firmographic filters:

- Industry/Vertical: A manufacturing company’s challenges look nothing like a SaaS startup’s

- Company Size: A 50-person company operates differently than a 5,000-person enterprise

- Revenue: Budget constraints change everything about buying decisions

- Geographic Location: Regulations, cultures, and business practices vary by region

- Growth Stage: Startups move fast; enterprises move slow; each needs different messaging

B2C businesses rely on demographics — age, gender, income, education, family status. This data is easier to find and cheaper to collect than deep psychographic insights.

But here’s where most teams go wrong: they stop at surface-level data. If you’re targeting CMOs, don’t just filter by job title. Dig into their experience level, industry background, and where they go for information.

Build detailed buyer personas

Market segments tell you who to target. Buyer personas tell you how to talk to them.

A solid persona captures:

- Professional details: Role, company size, industry, career history

- Daily reality: What does winning look like in their job?

- Pain points: What keeps them up at night about current solutions?

- Information sources: Where do they research and learn about new tools?

- Decision drivers: What finally pushes them to buy?

Most successful companies start with 2-5 personas and expand from there. Each persona should be different enough to need its own messaging approach — a CFO cares about ROI while an end user cares about ease of use.

Example: “Marketing Director Mike” works at a 200-person SaaS company, has 8 years of experience, and gets measured on pipeline generation. He’s frustrated with tools that promise easy setup but require engineering help.

Validate with real customer data

Too many companies build personas based on gut feelings instead of facts. Your assumptions about customers are usually wrong.

Start with quantitative data:

- Analytics tools show you actual user behavior patterns

- CRM records reveal trends across your customer base

- Website analytics tell you who’s actually visiting and converting

Then add qualitative insights:

- Customer interviews give you the real story behind the data

- Surveys help you understand needs at scale

- Focus groups show you how people talk about your category

The goal isn’t perfection — it’s useful insight. Look for patterns that separate one customer type from another. Each distinct pattern becomes a potential persona worth targeting.

Keep updating your personas as you learn more. Customer needs shift, markets change, and your personas should evolve with them.

Step 2: Craft a Clear Value Proposition

“Whether you’re an entrepreneur, a small business, or a Fortune 500 company, great marketing is all about telling your story in such a way that it compels people to buy what you are selling. That’s a constant. What’s always in flux, especially in this noisy, mobile world, is how, when, and where the story gets told, and even who gets to tell all of it.” — Gary Vaynerchuk, CEO of VaynerMedia, marketing expert

Once you know who you’re targeting, you need to nail down why they should care. Your value proposition is what separates you from the sea of “me too” solutions flooding every market. It’s not marketing fluff—it’s the core reason customers will choose you over everyone else.

Identify customer pain points

Your value proposition needs to solve real problems, not imaginary ones. Customer pain points are the frustrations, roadblocks, and unmet needs that keep your prospects awake at night. Miss these, and your solution becomes irrelevant fast.

Pain points generally fall into four buckets:

Financial pain points: Anything hitting the bottom line—high costs, poor ROI, budget constraints

Productivity pain points: Tasks that take forever, inefficient workflows, time-wasting processes

Process pain points: Internal procedures that create bottlenecks or confusion

Support pain points: Lack of help when customers need it most

The Four Fs Framework cuts through the noise: First (what are they trying to accomplish first?), Finest (what do they value most?), Failure (where are current solutions failing?), and Future (what’s their ideal outcome?). This approach gets you past surface-level complaints to the real issues.

Customer interviews beat surveys every time for uncovering pain points. You’re not just learning what people do—you’re discovering why they do it and where they hit walls. Talk to your biggest fans, your harshest critics, and the ones who almost bought but didn’t.

Analytics data shows you where people actually struggle, not just where they say they struggle. Heat maps, user flows, and drop-off points reveal friction you might never hear about in interviews.

Differentiate from competitors

Being slightly better isn’t enough. Your differentiation needs to be obvious and meaningful enough to change buying decisions.

Too many companies play follow-the-leader instead of carving out their own space. The result? Everyone sounds exactly the same. Hotels all offer free shampoo but no toothbrush—not because it makes sense, but because everyone copies everyone else.

Real differentiation starts with understanding what your competitors can’t or won’t do. Then you build your entire value proposition around that gap. Features don’t sell—solutions to problems sell.

Start with competitive analysis. Map out where competitors are strong and where they’re weak. Those weak spots are your opportunities. But here’s the catch: your strength only matters if your target market actually cares about it. Being the fastest doesn’t help if your customers value reliability over speed.

Test your messaging with real users

Even brilliant value propositions fail if nobody understands them. Message testing shows you what actually works with real customers, not what sounds good in conference rooms.

Test in three stages:

- Validate the problem: Do customers actually have the pain points you think they do?

- Test the solution: Which parts of your value proposition resonate most?

- Check willingness to pay: Will they actually buy at your price point?

Here’s a reality check: messaging impacts conversions twice as much as design. If customers can’t explain what you do after seeing your pitch, your messaging needs work.

Bottom line: Your value proposition isn’t set in stone. Markets shift, customer needs change, and new competitors emerge. Keep testing and refining based on real feedback, not internal assumptions. The best value propositions evolve with their markets.

Step 3: Choose the Right Pricing Strategy

Your pricing strategy can make or break your entire GTM plan. You could nail your target market and craft the perfect value proposition, but price it wrong and watch everything fall apart.

Cost-plus vs. value-based pricing

Cost-plus pricing is the safe play: add up your costs, slap on a markup percentage, and call it done. It feels logical and protects your margins, which is why manufacturing, retail, and government contractors rely on it. Every sale covers expenses and contributes to profit.

But safe doesn’t always mean smart. Cost-plus pricing ignores what customers actually want to pay, discourages cost control, and often leaves serious money on the table. For subscription businesses where most costs hit upfront, it’s practically useless.

Value-based pricing flips the script entirely. Instead of starting with your costs, you start with what customers believe your solution is worth. This approach has become the gold standard for SaaS companies because it forces you to focus on customer outcomes rather than internal expenses.

The 10x rule provides a simple starting point: price your solution at roughly 1/10th of the value it delivers. If you save a customer $5,000 monthly, a $500 price point lets them see massive ROI while keeping your margins healthy.

Freemium, flat-rate, or usage-based models

Once you’ve settled on your pricing philosophy, you need to pick a specific model that matches your product and audience.

Flat-rate pricing keeps things simple: one price, all features, no surprises. Customers love the predictability, but you might struggle to capture value as their usage grows.

Usage-based pricing charges customers for what they actually consume—API calls, storage, data processing. This model has exploded in popularity, with over two-thirds of tech companies adopting usage-based or hybrid approaches in 2024. It aligns perfectly with customer success, but can make budgeting tricky for buyers.

Tiered pricing offers the best of both worlds: multiple packages with different features and limits. Most SaaS businesses prefer this approach because it lets them target various customer segments without overwhelming anyone.

Freemium models give away basic features while charging for premium ones. It’s become the playbook for consumer apps and can dramatically reduce acquisition costs. The catch? Only 2-5% of free users typically convert to paying customers. You’ll be supporting a lot of users who generate zero revenue.

Before going freemium, ask yourself: What’s the real benefit? Do you have a solid plan for converting free users to paid ones?

Align pricing with customer expectations

Here’s what matters most: your pricing has to make sense to customers, not just you.

Choose a transparent pricing metric that connects directly to your value proposition. If customers can’t immediately understand how you charge, they won’t be able to explain it to their boss or budget committee. Nobody signs blank checks.

Customer behavior often surprises companies. Time Warner Cable discovered their customers preferred paying more for unlimited service rather than paying less for usage-based plans. Predictability often beats potential savings.

For usage-based models, consider these customer-friendly approaches:

- Usage dashboards that predict future billing

- Reconciliation periods that adjust for actual consumption

- Hybrid models with some committed usage for predictability

Bottom line: Your pricing strategy touches every part of your GTM execution—marketing campaigns, sales coverage, customer success planning. Get it right by balancing your internal needs with what customers actually want to pay and how they prefer to be charged.

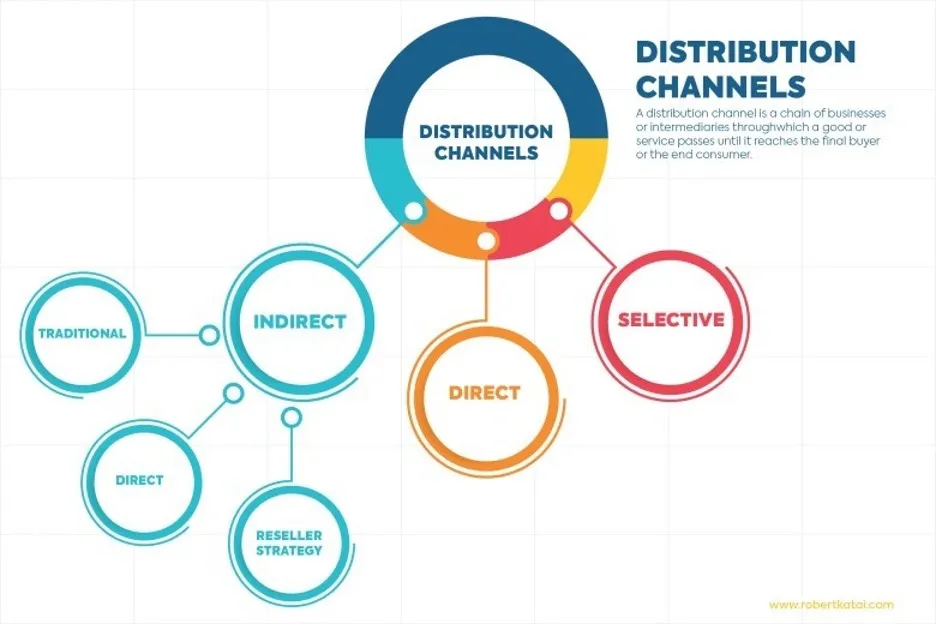

Step 4: Select Your Sales and Distribution Channels

Image Source: Incisive Edge

Your sales channels are what turn strategy into revenue. You can nail everything else—market definition, pricing, messaging—but pick the wrong distribution model and watch your launch fizzle.

Direct vs. indirect sales models

Direct distribution means you sell straight to customers without middlemen. You control the entire experience, keep all the profit, and own the customer relationship from start to finish.

Here’s what direct sales gets you:

- Complete control over customer experience

- Higher profit margins since you’re not splitting revenue

- Direct feedback loop for product improvements

- Consistent brand messaging

But direct channels cost more upfront. You’ll need infrastructure, logistics systems, and sales staff. The payoff comes later when these channels become more efficient than working through partners.

Indirect distribution uses third parties—resellers, distributors, channel partners—to reach customers. You tap into their existing networks, relationships, and market knowledge.

Benefits of going indirect:

- Faster market penetration, especially in new regions

- Lower fixed costs compared to building your own teams

- Scale across multiple geographies at once

- Access to specialized industry expertise

The downside? Less control over customer relationships and potentially higher prices for end customers due to markup layers.

Self-serve, inside sales, or field sales

Once you’ve picked direct or indirect, you need to choose your specific sales approach.

Self-service works for simple, low-cost products that don’t need much explanation. Customers buy online without talking to anyone. No sales team required, but you’ll need strong marketing to drive traffic.

Inside sales uses reps who work prospects remotely—phone, email, video calls. Good for medium-complexity products and price points. Requires building a sales team, but gives you more personalized engagement.

Field sales means face-to-face meetings with prospects. Essential for complex, high-ticket items that need extensive explanation. Expensive to maintain, but it’s still the best approach for enterprise deals over $100K.

Channel partner considerations

If you’re going the indirect route, partner selection makes or breaks your strategy.

Look for partners with:

- Deep industry knowledge so they can actually guide customers

- Established market presence and connections to your ideal buyers

- Complementary offerings that create mutual value

- Resources for enablement including time for training and support

Different partner types serve different purposes. Value-added resellers (VARs) customize your offering with services. System integrators bundle your product with others. Managed service providers handle ongoing maintenance and support.

Bottom line: Channel partnerships only work when both sides benefit. As one partnership expert puts it, “You should not do partnerships just for the sake of revenue. Channel partnerships should be driven by a genuine and organic need that aligns with business objectives”.

Step 5: Build a Promotion Plan That Converts

Your promotion plan is where strategy meets execution. You’ve defined your market, crafted your message, and picked your channels. Now you need tactics that actually drive conversions.

Top-of-funnel vs. bottom-of-funnel tactics

Top-of-funnel (TOFU) marketing targets people who don’t know you exist yet. They’re researching solutions, comparing options, and trying to understand their problem better. Your job here isn’t to sell—it’s to educate and build trust.

TOFU tactics that work:

- Content marketing that solves real problems your audience faces

- SEO optimization because 75% of people never scroll past the first page

- Social media marketing where your audience already hangs out

Bottom-of-funnel (BOFU) marketing is different. These people know their problem and are ready to buy something. They’re comparing you against competitors and looking for reasons to choose you. Retargeting campaigns can boost conversion rates by 150% here because you’re hitting people who’ve already shown interest.

BOFU focuses on removing friction from the buying process rather than creating awareness.

Paid vs. organic channels

Organic marketing builds long-term visibility through content that ranks in search, gets shared on social, or spreads through word-of-mouth. The upside? Content you publish today can drive traffic for months or years. The downside? It takes time to build momentum.

Paid marketing gets you immediate visibility but stops working the moment you stop paying. Pay-per-click (PPC) advertising lets you control exactly who sees your message and when. It’s perfect for testing messages quickly or driving short-term results.

Most successful companies use both. Organic builds the foundation while paid accelerates specific campaigns or fills gaps. Think of organic as your steady income and paid as the bonus that helps you hit quarterly targets.

Retargeting and ABM strategies

Retargeting is probably the closest thing to magic in digital marketing. Someone visits your pricing page but doesn’t buy. A tracking pixel drops a cookie in their browser. Two days later, they’re scrolling Instagram and see your ad. It’s like having a salesperson follow up without being pushy.

Here’s how it works: visitor checks your product → leaves your site → browses social media → sees your ad in their feed. Simple but effective.

Account-Based Marketing (ABM) flips traditional marketing upside down. Instead of casting a wide net, you pick specific high-value accounts and create personalized campaigns just for them. Your marketing and sales teams work together to win specific companies, not just generate leads.

ABM delivers results through:

- Custom content that speaks directly to each account’s challenges

- Targeted campaigns designed around specific companies

- Tight coordination between marketing and sales teams

The math is simple: focus your resources on accounts with the highest potential value instead of spreading efforts thin across thousands of prospects.

Step 6: Set Metrics and Track Performance

“Marketing without data is like driving with your eyes closed.” — Dan Zarrella, Social media scientist, author

Without the right metrics, you’re flying blind. Most GTM strategies fail because teams track vanity metrics instead of numbers that actually predict success.

Customer acquisition cost (CAC)

CAC tells you exactly how much you’re paying to land each new customer. The math is simple: CAC = Total Marketing and Sales Costs ÷ Number of New Customers Acquired.

For better accuracy, use this formula: CAC = (Marketing Campaign Costs + Wages + Software + Professional Services + Overhead) ÷ Total Customers Acquired.

Here’s the benchmark that matters: keep CAC at 33% or less of your customer lifetime value. Go higher than that, and you’re burning cash faster than you can make it back.

Sales cycle length

This metric shows how long prospects take to become paying customers—from first contact to signed deal. Long cycles usually mean friction somewhere in your process.

Shorter cycles signal an efficient GTM machine that moves people through your pipeline smoothly. Plus, tracking cycle length helps you forecast revenue and allocate resources more accurately.

Deal complexity drives cycle length. Enterprise deals with multiple stakeholders naturally take longer than simple self-serve purchases.

Conversion rates by channel

Conversion rates by channel reveal which marketing channels actually turn prospects into customers. This insight helps you double down on what works and cut what doesn’t.

Calculate it by dividing conversions by total visitors from each channel, then multiply by 100. Most teams miss this and end up undervaluing channels that assist conversions without getting direct credit.

Keep in mind that conversion rates shift based on traffic sources, seasons, and device types—context matters when analyzing these numbers.

Learn from Real GTM Strategy Examples

Image Source: Dr Gary Fox

Real-world examples show you what actually works when it comes to go-to-market strategies. Here are three companies that nailed their GTM execution and the results that followed.

Apple iMac G3 launch

Apple’s 1998 iMac G3 launch broke every rule in the computer industry playbook. While competitors stuck to beige boxes and enterprise messaging, Apple went translucent and consumer-focused.

The strategy was simple: price the iMac at $1,299—well below the $2,000 entry point most computers demanded. Apple backed this with a $100 million advertising blitz that hammered home ease of use and internet connectivity. Their ads didn’t just promote features; they called out competitors for being stuck in “thinking jail” with boring beige designs.

The numbers tell the story: 278,000 units sold in six weeks, 800,000 after 20 weeks. Nearly half came from first-time computer buyers, and Apple grabbed 20% of Windows users. That single product helped Apple flip from an $878 million loss in 1997 to a $414 million profit in 1998.

Peloton’s retail-first approach

Most fitness companies go straight to online sales. Peloton did the opposite—they built showrooms where people could actually try their bikes before buying.

Their Chief Revenue Officer put it clearly: “Our showrooms are designed with sales, experience, and community in mind”. The hands-on experience mattered because “the magic happens when you hop on a Bike, put on the headphones, lock into a class, and start riding”.

What’s interesting is that bigger didn’t mean better. Their first Los Angeles showroom was just 350 square feet, but it still moved plenty of bikes. This discovery led to their “microstore” rollout in high-traffic locations. Today, Peloton has expanded this approach through partnerships with Target and Nordstrom.

Cognism’s Diamond Data rollout

Cognism built their GTM strategy around concrete results rather than vague promises. They led with specific outcomes: 80% connect rates, $125,000 in pipeline from mobile numbers, and 30% higher conversion rates.

Their pitch focused on phone-verified contact data delivering 3X higher connection rates. They also positioned themselves as the compliance-first option with extensive Do Not Call registry coverage across multiple countries.

Customer testimonials drove their messaging. One buyer explained: “In the evaluation process, we compared Cognism against five competitors… our results showed that the coverage of US mobile data far outperformed the others”.

Each of these companies succeeded because they aligned their GTM strategy with real customer needs and backed up their claims with measurable results.

GTM Strategy: To Sum It All Up

The math hasn’t changed: four out of five product launches still fail. But now you know why most companies join that 80% and how to avoid their mistakes.

GTM strategies fail when companies skip the fundamentals. They assume they know their customers without talking to them. They copy competitors instead of finding real differentiation. They pick pricing models that feel safe rather than ones that work. They choose channels based on what’s trendy instead of what fits their product.

The companies that win do the opposite. They build detailed customer profiles from real data, not guesswork. They craft value propositions that solve actual pain points. They test pricing models with real prospects. They choose distribution channels that match how their customers actually want to buy.

Your promotion strategy needs to work at both ends—awareness campaigns that get attention and conversion tactics that close deals. Track the metrics that matter: how much customers cost to acquire, how long sales take, and which channels actually convert.

Apple, Peloton, and Cognism succeeded because they executed these basics relentlessly. They didn’t try to be clever—they focused on understanding their customers and delivering what those customers wanted through the right channels at the right price.

Bottom line: Your GTM strategy isn’t a document you write once and forget. Markets shift, customers change, competitors adapt. Treat your strategy as something that needs regular updates based on what’s actually happening in the field.

Start applying these principles to your next launch now. Get clear on who you’re selling to, what problem you’re solving for them, and how you’ll reach them profitably. Do that work upfront, and you’ll join the 20% that actually succeed.