Best Life Insurance Lead Generation Companies 2025

The game has shifted from list-buying to pipeline building. Whether you need a few exclusive leads per day or want to scale nationwide outreach, this guide breaks down 15 companies that specialize in qualified life insurance leads and shows how to choose the right one for your goals.

TL;DR:

- This guide covers the best life insurance lead generation companies in 2025

- Ideal for agents, brokers, and IMOs selling term, final expense, or whole life

- Includes platforms for live transfers, Facebook leads, aged leads, and DIY scrapers

- Breaks down pricing, delivery speed, lead types, and limitations

- Highlights how IGLeads lets you build lists from Facebook and Google without ads

- Helps you choose the right lead source for budget, control, and ROI

Quick comparison between life insurance lead generation tools

After reviewing dozens of life insurance lead providers, here’s a quick breakdown of five top options. Whether you’re scraping your own lead lists or paying for exclusive transfers, this table should help clarify the best fit for your workflow.

| Feature |  |

|

|

|

|

|---|---|---|---|---|---|

| Starting price (monthly) | $59.99 | Pay per lead | Pay per call | Pay per lead | Pay per lead |

| Key features | Scrapes Google, Maps, LinkedIn | Shared leads, filters by zip, age, income | Live transfers, licensed agents | Quote-form leads, delivery caps | Shared or exclusive leads, dashboard control |

| Lead type | Self-generated from social/search | Shared leads and live calls | Live call transfers | Shared web leads | Shared or exclusive web leads |

| Best for | Agents wanting control and low cost | Fast-paced agents with filters | Call-based closers with speed | High-volume CRM users | Flexible agents scaling campaigns |

| Notable limitations | No CRM, manual outreach required | Shared leads, fast response needed | Call-only, higher CPL | Shared only, fewer life-specific filters | Shared leads, exclusivity costs extra |

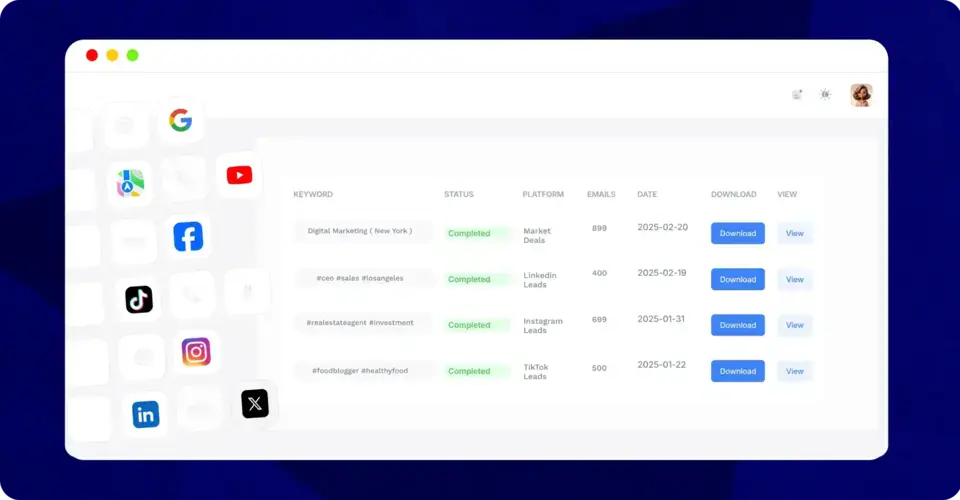

IGLeads

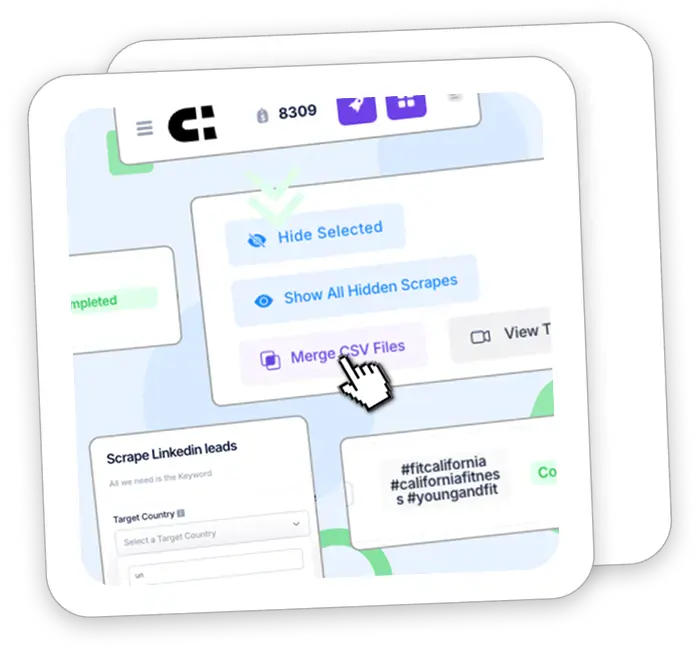

IGLeads is a scraping tool that helps agents build their own life insurance lead lists from platforms like Facebook, Google, LinkedIn, and more. Instead of buying leads from aggregators, you can use IGLeads to extract local or niche contacts based on keywords like “life insurance agent,” “term life,” or “final expense quotes” — all without writing code.

It’s ideal for outbound agents who want more control over targeting and want to avoid long-term lead contracts or recycled data.

IGLeads key features

- Scrapes Facebook profiles, business pages, and groups using keywords like “life insurance” or “financial advisor”

- Google Maps and LinkedIn scraping for local businesses, agents, and independent brokers

- Cloud-based operation — runs while your computer is off

- Export emails, phone numbers, names, and page links into CSV

- Filters by location, keyword, and industry

- Fast turnaround — results typically delivered in under 8 hours

- No credit system — flat monthly pricing with unlimited exports on most plans

With IGLeads, agents can create highly targeted cold outreach lists tailored to their niche, product focus, and service area.

IGLeads pros and cons

Pros

- Build unlimited life insurance lead lists without paying per lead

- Ideal for agents who prefer cold outreach or niche targeting

- Supports multi-platform scraping — including Facebook, LinkedIn, Google Maps

- Cloud-based and easy to use — no technical skills required

- No contracts, setup fees, or minimums

Cons

- Not a live lead provider, outreach is required via email, phone, or SMS

- Scraped data may need minor cleaning or formatting before use

- No built-in CRM or autoresponder features, best used alongside your existing tools

- Limited built-in support for campaign strategy or automated follow-up

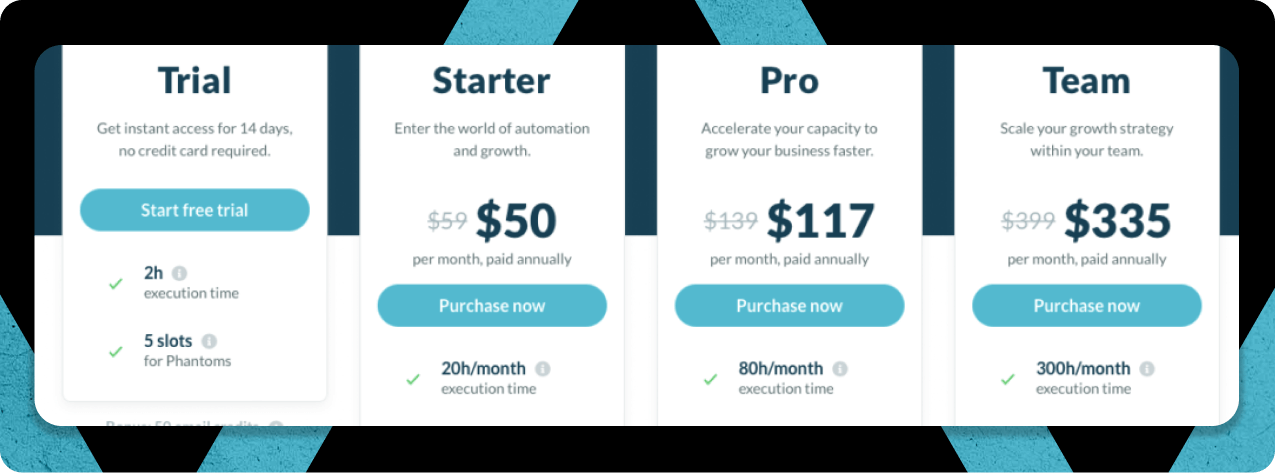

IGLeads pricing

- Starter: $59.99/month for up to 10,000 emails

- Business Plan: $149.99/month for 50,000 emails monthly, access to various scraping tools, including Instagram, Facebook, and LinkedIn.

- Unlimited Plan: $299.00/month for unlimited emails, full access to all email scrapers and data tools, plus priority scraping.

IGLeads best for

IGLeads is best for agents, agencies, or appointment setters who want full control over their life insurance lead generation. If you prefer building your own lists and running your own outreach — and don’t want to depend on pay-per-lead vendors — this is a budget-friendly and scalable solution.

SmartFinancial

SmartFinancial is a popular lead generation platform known for delivering exclusive, real-time insurance leads via inbound calls, web form submissions, and live transfers. The company captures prospects through paid search, display ads, and partner websites, then connects them directly to licensed agents based on product and location.

SmartFinancial focuses on lead quality and fast delivery, making it a strong fit for agents ready to quote policies on the spot.

SmartFinancial key features

- Exclusive or shared life insurance leads with customizable filters

- Real-time delivery by live transfer or direct-to-CRM

- Call verified leads and TCPA compliance across all sources

- Adjustable campaign settings with pause and resume options

- No long-term contracts — pay-as-you-go model

- Dedicated support and performance reporting dashboard

SmartFinancial doesn’t just generate leads — it qualifies and routes them based on coverage interest, budget, and availability, helping agents speak to serious buyers while they’re still engaged.

SmartFinancial pros and cons

Pros

- High-intent leads delivered instantly

- Live transfers available for phone agents

- No contracts or large upfront fees

- Transparent billing and real-time performance tracking

- Excellent support and campaign flexibility

Cons

- Cost per lead is higher than aged lead vendors

- Competitive territories may have limited volume

- Requires quick response time for best results

- Not ideal for slow-moving or part-time agents

SmartFinancial pricing

- Lead prices range from $20 to $60 depending on filters and lead type

- Live transfers are priced higher based on product and call duration

- No setup fees or contracts — minimum budget required to launch a campaign

- Pay-per-lead model with full access to dashboard and reporting

SmartFinancial best for

SmartFinancial is best for agents and brokerages that want high-quality, exclusive life insurance leads with real-time delivery. If you’re ready to quote policies quickly and prefer live calls or web leads you can close today, SmartFinancial is a strong option.

Datalot

Datalot is a real-time call transfer platform that connects licensed insurance agents with consumers actively shopping for coverage. Unlike traditional lead vendors that sell contact details, Datalot delivers inbound calls from verified prospects in your target market — typically within seconds of the user submitting a quote request.

The platform is built for agents who want speed, volume, and voice-to-voice selling.

Datalot key features

- Real-time phone call transfers to licensed agents

- Smart routing based on state, product type, and availability

- TCPA-compliant leads sourced from online quote forms

- Call handling tools and dashboards to track agent performance

- Optional call recording and post-call analytics

- Integration with major CRMs and dialers

Datalot runs a proprietary ad network that attracts insurance shoppers across life, health, auto, and home — then matches them to agents via dynamic call routing.

Datalot pros and cons

Pros

- Instant inbound calls from interested shoppers

- Strong compliance and lead vetting system

- Call tracking, reporting, and analytics included

- Integrates with most agency systems

- Excellent for agents who sell over the phone

Cons

- Requires a consistent call answer rate to maintain quality

- Lead pricing is higher than static lead lists

- Call volume varies based on campaign and geography

- Minimum budgets may apply for new accounts

Datalot pricing

- Live call transfers start around $25 to $70 per call, depending on coverage type and filters

- Minimum daily or weekly budgets may be required

- Pricing varies by geography, lead volume, and product (term, whole, or final expense)

Datalot best for

Datalot is best for life insurance agents and teams that want inbound phone leads delivered in real time. It’s ideal for high-volume producers, telesales reps, or brokers with systems in place to handle and convert phone calls quickly.

EverQuote Pro

EverQuote Pro is a lead generation platform that connects life insurance agents with consumers actively shopping for coverage through the EverQuote.com comparison site. When users fill out quote requests online, their information is matched and distributed to licensed agents in real time — making it a high-volume source of buyer-intent leads.

EverQuote operates across life, auto, health, and home insurance, but has become a go-to source for life agents looking for consistent lead flow.

EverQuote Pro key features

- Real-time delivery of consumer-generated life insurance leads

- Filters by location, coverage type, income, and more

- Lead volume control with daily budget caps

- Lead management dashboard with performance insights

- Integrates with CRMs and auto-dialers

- Option to pause, resume, or adjust targeting on demand

EverQuote generates its leads through SEO, paid ads, and comparison tools, then routes them to agents who opt into specific filters and budgets.

EverQuote Pro pros and cons

Pros

- Large volume of inbound consumer leads

- Strong brand recognition improves conversion trust

- Fast lead delivery with flexible campaign management

- Transparent billing and reporting tools

- Integrates easily into existing workflows

Cons

- Leads are often shared with multiple agents

- No live transfers — leads arrive via email or CRM

- Conversion depends heavily on fast follow-up

- Limited ability to preview lead quality before purchase

EverQuote Pro pricing

- Pricing varies by lead type and location, typically $20 to $50 per lead

- Monthly ad spend minimums may apply for access to higher volumes

- No setup fees or long-term contracts required

EverQuote Pro best for

EverQuote is best for life insurance agents who want steady lead flow from online shoppers and are equipped to follow up quickly. It’s a strong fit for solo agents or agencies looking to scale with web leads, especially those with email or phone follow-up systems already in place.

NextGen Leads

NextGen Leads is a real-time lead platform that delivers highly targeted life insurance prospects to agents through a transparent, self-serve dashboard. Known for speed, clarity, and campaign control, NextGen allows you to buy web leads and call transfers with detailed filters — without contracts or surprise fees.

Unlike some legacy providers, NextGen is built for modern agents who want control, clean data, and flexibility.

NextGen Leads key features

- Real-time life insurance leads with custom filtering

- Detailed targeting by age, coverage type, income, location, and more

- Lead caps, delivery windows, and pause/resume tools

- Option to buy exclusive or shared leads

- Phone verification on select lead types

- CRM and dialer integrations available

The platform offers a clear interface with real-time performance stats, lead returns, and billing — making it easy to scale or stop as needed.

NextGen Leads pros and cons

Pros

- Transparent platform with no long-term commitment

- High-quality filters improve targeting and conversion

- Quick lead delivery with adjustable caps

- Real-time reporting and easy-to-use dashboard

- Excellent customer service and onboarding support

Cons

- Lead cost can rise quickly in competitive territories

- Shared leads require fast response to win deals

- Lead volume varies depending on selected filters

- Limited offline or traditional media sources

NextGen Leads pricing

- Leads start at around $20 to $45 each, depending on exclusivity and targeting

- Pay-as-you-go model — no contracts, setup fees, or minimums

- Optional call transfers available at a higher rate

- Refunds available for invalid or unresponsive leads within policy limits

NextGen Leads best for

NextGen is best for life insurance agents who want to buy leads on their own terms, without setup fees or long-term commitments. It’s especially useful for agents who value real-time targeting and want a clean, flexible platform to manage lead flow and ROI.

Leadco

Leadco is a full-service life insurance lead provider that offers TCPA-compliant internet leads, live transfers, and aged lead packages for agents and multi-agent teams. The platform emphasizes quality control, campaign transparency, and strong support, making it a solid option for both independent producers and IMOs.

With proprietary data sources and real-time filtering, Leadco focuses on delivering accurate, responsive leads that fit your sales workflow.

Leadco key features

- Real-time life insurance leads and live call transfers

- Shared or exclusive leads with customizable filters

- TCPA-compliant lead generation and consent documentation

- Campaign dashboard with daily performance tracking

- Lead replacement options for invalid or unreachable contacts

- Dedicated support for agency-level account setup and scaling

Leadco works with agents across life, health, and final expense verticals, and also provides lead portal access for agencies managing multiple producers.

Leadco pros and cons

Pros

- Compliant, reliable lead sources with strong vetting

- Multiple delivery methods: live transfer, email, CRM

- Works well for both solo agents and large teams

- Refund and lead return policy available

- Strong agency support and scalability

Cons

- Exclusive leads come at a higher cost

- Lead volume can fluctuate in niche or rural areas

- Requires consistent follow-up for best conversion rates

- Smaller user dashboard compared to some modern platforms

Leadco pricing

- Shared leads: $15 to $30 per lead

- Exclusive leads: $40 to $60+, depending on filters and location

- Live transfers priced separately based on qualification and call duration

- Custom pricing available for agency accounts and high-volume buyers

Leadco best for

Leadco is best for agents and agencies looking for reliable, compliant life insurance leads with flexible campaign setup and real-time support. If you’re scaling a multi-producer team or want a trusted vendor with refund options and campaign visibility, Leadco is a strong pick.

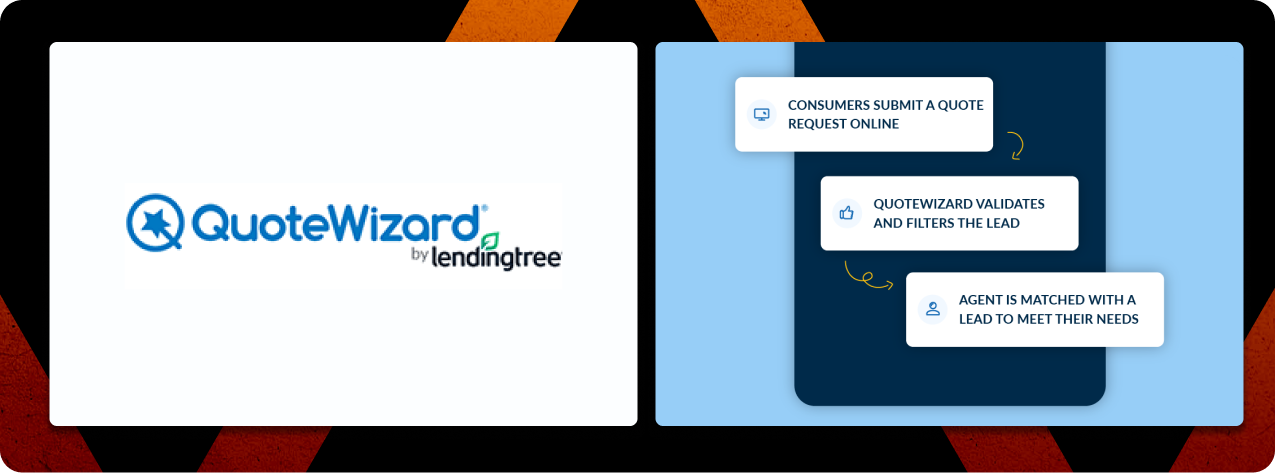

QuoteWizard

QuoteWizard, a LendingTree company, is a long-standing insurance lead provider that generates high-volume, intent-based leads across life, auto, home, and health. For life insurance agents, QuoteWizard delivers shared web leads and live call transfers from consumers actively comparing quotes through its owned-and-operated websites and traffic partners.

The platform focuses on scale, reach, and flexible campaign controls, making it a common choice for large agencies and aggressive outbound teams.

QuoteWizard key features

- High-volume life insurance web leads and call transfers

- Shared or semi-exclusive options available

- Real-time delivery to email or CRM

- TCPA-compliant lead generation with consent tracking

- Adjustable lead caps, filters, and budgets

- Dedicated account management and onboarding support

QuoteWizard uses a broad network of traffic sources to generate consistent volume, ideal for agents with dialer systems and fast follow-up capacity.

QuoteWizard pros and cons

Pros

- Steady lead volume across most U.S. markets

- Real-time lead delivery with campaign controls

- Integrates with most CRMs and dialing systems

- Flexible pricing and volume scaling

- Strong brand recognition helps build trust with consumers

Cons

- Most leads are shared with multiple agents

- Requires aggressive follow-up to compete

- Mixed reviews on lead quality and conversion rates

- Pricing can vary widely depending on competition and targeting

QuoteWizard pricing

- Shared life insurance leads typically range from $15 to $35 each

- Live call transfers start around $40 to $70, depending on filters

- Volume discounts and custom plans available for agencies

- No setup fee, but minimum budget may apply to launch

QuoteWizard best for

QuoteWizard is best for agents and agencies that prioritize scale and are equipped to follow up on shared leads quickly. It’s especially suited for call centers, high-volume brokers, or anyone looking to keep a large sales team fed with consistent web or phone leads.

ZipQuote

ZipQuote is a lead generation company focused on delivering high-intent life insurance leads through digital funnels, paid media, and proprietary landing pages. Originally known for its success in auto and home insurance, ZipQuote has expanded into the life and final expense vertical with strong filtering options and lead delivery infrastructure.

The platform is optimized for agents who want pre-qualified, TCPA-compliant web leads delivered in real time.

ZipQuote key features

- Real-time life and final expense insurance leads

- Consumer-initiated web leads with customizable filters

- TCPA-compliant opt-in process with lead verification

- Integrates with CRMs and lead management systems

- Transparent campaign tracking and support

- Dedicated onboarding for new agents and agencies

ZipQuote works well for agents looking to capture leads earlier in the buying cycle, while still maintaining control over targeting, delivery speed, and lead volume.

ZipQuote pros and cons

Pros

- Consistent life and final expense lead flow

- Real-time delivery with strong data accuracy

- Lead filtering by location, age, income, and product type

- CRM integration and reporting tools included

- Flexible volume controls and campaign support

Cons

- Shared leads unless upgraded to exclusive pricing

- Less brand recognition than some competitors

- Volume can vary depending on geography

- Requires quick follow-up to convert leads efficiently

ZipQuote pricing

- Life insurance leads typically priced between $20 and $40 each

- Final expense leads may run higher depending on targeting

- Exclusive lead options available at higher rates

- Minimum monthly ad spend may apply to launch campaigns

ZipQuote best for

ZipQuote is best for agents and agencies looking to scale final expense or term life sales with TCPA-compliant, real-time leads. It’s especially valuable for producers who want clean data, campaign control, and consistent support without having to manage their own marketing funnels.

Benepath

Benepath is a premium lead generation company that provides exclusive, real-time life insurance leads to licensed agents. Unlike shared lead networks, Benepath only sells each lead once and requires consumers to complete a detailed quote request before connecting them with a matched agent. This focus on exclusivity and buyer intent makes it a strong option for agents who prioritize quality over quantity.

Benepath also offers phone-verified leads and additional filters to improve close rates.

Benepath key features

- 100% exclusive life insurance leads — never shared

- Real-time web lead delivery via email or CRM

- Customizable filters: age, zip code, product interest, income level

- Phone verification available on request

- TCPA-compliant sourcing and opt-in tracking

- Dedicated onboarding, training, and account management

Benepath’s screening process includes multi-step lead forms and optional verification steps, which help eliminate casual shoppers and increase connection rates.

Benepath pros and cons

Pros

- Truly exclusive leads improve conversion odds

- Higher buyer intent from long-form lead capture

- Optional phone-verified lead upgrades

- No lead recycling or aggressive reselling

- Excellent support and transparent lead return policy

Cons

- Higher price point than shared lead platforms

- Lead volume may be limited in smaller markets

- No call transfers — web leads only

- Requires strong follow-up process to maximize ROI

Benepath pricing

- Life insurance leads typically range from $40 to $60+

- Phone-verified leads available at a higher tier

- Minimum spend requirements may apply depending on territory

- Monthly billing with refund/return credit system in place

Benepath best for

Benepath is best for life insurance agents who want exclusive, high-quality leads and are willing to pay a premium for better close rates. It’s ideal for solo producers and small agencies looking to reduce competition and increase ROI from each lead purchased.

Lead Planet

Lead Planet is a specialized lead vendor offering a wide range of life insurance leads, including real-time internet leads, aged data, final expense, and live call transfers. Known for flexibility and variety, the platform caters to independent agents and agencies that want to customize campaigns by lead type, delivery speed, and budget.

Lead Planet supports multiple verticals but has a strong foothold in life insurance and senior market products.

Lead Planet key features

- Real-time and aged life insurance leads (term, whole, final expense)

- TCPA-compliant sourcing from owned web properties

- Live call transfers and phone-verified leads available

- Options to filter by state, product, income, and age range

- Bulk purchase options for aged leads at discounted rates

- Lead delivery via email, CRM, or portal dashboard

Lead Planet stands out for agents looking to blend low-cost aged leads with a few high-quality real-time prospects to balance budget and volume.

Lead Planet pros and cons

Pros

- Wide selection of lead types, including aged, live, and verified

- Budget flexibility for agents testing different approaches

- One-off orders available — no long-term contracts

- Final expense and term life focus available

- Transparent delivery process and refund policies

Cons

- Not all leads are exclusive unless specified

- Aged data may include outdated contact info

- Website interface is basic compared to newer tools

- Fewer integrations compared to modern CRMs

Lead Planet pricing

- Aged leads: as low as $0.25 to $2 per lead, depending on age and volume

- Real-time leads: typically $25 to $45 each

- Live transfers and verified leads cost more depending on filters

- Custom packages available for agencies and high-volume buyers

Lead Planet best for

Lead Planet is best for agents who want flexible lead buying options — especially those combining real-time life insurance leads with aged lists for outbound calling. It’s a good fit for producers who want to scale gradually without committing to a fixed monthly contract.

Anomaly Squared

Anomaly Squared isn’t just a lead provider — it’s an outbound call center that partners with life insurance agencies to generate, qualify, and schedule appointments with real prospects. Rather than selling lists or sending raw leads, Anomaly Squared offers full-service lead nurturing through human outreach, making it ideal for agents who want a done-for-you pipeline.

It’s a strong option for IMOs, brokerages, or teams without in-house SDRs.

Anomaly Squared key features

- U.S.-based outbound call center that sets appointments

- Focus on life, health, and final expense lead qualification

- Scripts customized to fit your product and audience

- Integration with most CRMs and sales tools

- Agents operate as white-labeled reps on your behalf

- Performance tracking and reporting built in

Anomaly Squared doesn’t just pass leads — they warm them up through multiple calls and hand them off once interest and eligibility are confirmed.

Anomaly Squared pros and cons

Pros

- You don’t have to cold call — their reps do the work

- Custom scripts and dedicated calling agents

- Qualified appointment setting rather than raw data

- Transparent reporting and accountability

- Scales well for agencies or growing teams

Cons

- Higher price than self-managed leads or scraping tools

- Less control over outreach timing and messaging

- Minimum contract periods may apply

- Not ideal for solo agents with small budgets

Anomaly Squared pricing

- Pricing is customized based on call volume, campaign goals, and appointment targets

- Typically charged on a monthly retainer plus performance-based fees

- Ideal for agencies able to commit to 50–100+ appointments per month

- No off-the-shelf lead pricing — full-service engagement only

Anomaly Squared best for

Anomaly Squared is best for life insurance agencies that want a turn-key appointment setting solution with no internal cold calling. If you’re running a sales team or scaling production and need consistent, qualified calls booked on your calendar, this is a strong option.

Hometown Quotes

Hometown Quotes is a long-established insurance lead vendor offering real-time life insurance leads and call transfers to agents across the U.S. Built with agents in mind, the platform emphasizes simplicity, speed, and service — delivering consumer-requested quotes in real time through a user-friendly dashboard or direct-to-email.

They focus on quality over scale, with human-reviewed leads and personalized onboarding support.

Hometown Quotes key features

- Real-time life insurance leads with web opt-in

- Optional live call transfers

- Filters for age, zip code, coverage amount, and product type

- TCPA-compliant sources and manual lead review

- Delivery via email, dashboard, or CRM integration

- Lead replacement for bad data or disconnects

The company also offers aged leads and shared options for agents with tighter budgets or higher call capacity.

Hometown Quotes pros and cons

Pros

- Simple and agent-friendly setup process

- Responsive customer service team

- Real-time leads help you reach prospects while interest is fresh

- Call transfer option available

- Refund policy for invalid or unresponsive leads

Cons

- Lead volume may be limited in rural or niche markets

- Shared leads mean you’ll face competition

- No exclusive options in standard plans

- Smaller platform with fewer advanced features

Hometown Quotes pricing

- Shared real-time leads typically range from $20 to $35 each

- Call transfers start around $40 to $60 per call

- Discounts for volume or recurring orders may apply

- No long-term contracts — flexible month-to-month setup

Hometown Quotes best for

Hometown Quotes is best for life insurance agents who want a low-friction lead buying process with fast delivery and solid customer support. It’s a strong fit for newer agents or independent producers who want to start small and grow their outreach over time.

Zenernet Leads

Zenernet Leads is a performance-based lead service originally built for solar and home services, but now expanded into life insurance through strategic partnerships and digital funnels. The platform offers pre-qualified life insurance leads that are generated through targeted ad campaigns and delivered via CRM or dashboard.

While it’s not as widely known in the insurance space, it provides cost-per-lead flexibility and transparent campaign reporting.

Zenernet Leads key features

- Pre-qualified, web-based life insurance leads

- Filters by age, income, zip code, and product type

- Leads generated through digital ads and landing pages

- Transparent reporting with CPL optimization

- TCPA-compliant lead sourcing with opt-in verification

- Integrates with CRMs and lead routing tools

Zenernet is newer in the insurance vertical but brings performance marketing expertise and granular targeting to agents looking for scalable acquisition options.

Zenernet Leads pros and cons

Pros

- Flexible cost-per-lead model

- Transparent performance tracking and ROI focus

- Strong digital marketing team behind lead generation

- Customizable filters and daily caps

- Integration support for tech-savvy teams

Cons

- Limited brand awareness in the life insurance space

- Lower volume compared to legacy providers

- May require larger ad budgets for consistent delivery

- Fewer lead types (no live transfers)

Zenernet Leads pricing

- Life insurance leads start around $25 to $40 per lead

- Custom campaign pricing based on targeting and volume

- No setup fees, but a minimum ad budget may be required

- Direct billing with reporting access included

Zenernet Leads best for

Zenernet is best for modern life insurance agencies and producers that want performance-based, ad-driven lead generation with flexibility to scale. It’s ideal for tech-forward teams looking to test CPL-based campaigns without committing to long contracts or outdated lead lists.

What do life insurance lead providers actually do?

Life insurance lead generation companies connect agents with people actively searching for coverage. These aren’t just random contact lists — most providers run paid ads, manage high-traffic websites, or partner with aggregators to capture intent-driven leads. Some even operate full-service call centers that qualify and transfer prospects live to your phone.

Lead types vary by provider. Some companies specialize in exclusive leads that are sold to only one agent, while others offer shared leads at a lower cost. You can also buy aged leads — contacts who inquired days or weeks ago — at a fraction of the price.

Here’s how most life insurance lead services work:

- Inbound traffic capture through websites, Facebook ads, or search engines

- Lead qualification based on filters like age, zip code, coverage type, or income

- Lead delivery via live transfer, real-time email, CRM integration, or bulk file

- Automation and tracking tools for follow-up, lead status, and performance metrics

Some platforms, like IGLeads, take a different approach — helping you build lead lists manually by scraping search results, social media profiles, and business directories, so you can run your own outreach campaigns.

Whether you’re selling final expense by phone or term life policies in person, these tools give you a head start by filling your pipeline with people who’ve already shown interest in getting covered.

What to look for in a life insurance lead generation company

Not all lead providers deliver the same value. Some will flood your CRM with unresponsive contacts, while others charge premium prices for live calls with high-intent prospects. Before you sign up, here are the key factors that matter when buying life insurance leads in 2025:

Lead type

Know what you’re buying — live transfers, real-time web leads, shared leads, or aged leads. Exclusive leads cost more but reduce competition. Shared leads are cheaper but often require faster follow-up.

Delivery method

Some leads arrive by live phone call. Others come in by email, CRM integration, or dashboard download. Make sure the delivery method works with your workflow or tech stack.

Filters and targeting

Good providers let you set filters by product (term, final expense, whole life), age range, location, income, or language. The more control you have, the more relevant your leads will be.

Compliance

Look for TCPA-compliant vendors that collect consent before transferring or selling a lead. If you’re dialing, make sure the data is safe to use under federal and state regulations.

Pricing and minimums

Some companies charge per lead, while others bundle leads into monthly packages. Watch out for volume minimums, setup fees, or long-term contracts that lock you in before you see results.

Return and refund policy

Top vendors offer lead return policies for bad contact info or duplicates. Others don’t — which means you pay full price no matter what. Always check their return terms before you commit.

Support and responsiveness

You want fast access to your account manager or support team — especially if you’re scaling campaigns. Some providers offer live chat and lead pause functions. Others route you through email-only systems.

Which life insurance lead provider is right for you?

Choosing the right provider depends on your workflow, budget, and outreach strategy. Here’s how to decide:

- For self-directed outreach:

Use IGLeads to build your own lead lists from platforms like Facebook, Google Maps, and LinkedIn.

Best for agents who prefer cold email, SMS, or custom targeting — no per-lead fees. - For real-time leads:

Choose SmartFinancial or Datalot to get leads via live transfers or web forms.

Ideal for agents ready to quote policies immediately and follow up quickly. - For appointment setting:

Go with Anomaly Squared if you want a done-for-you service that handles cold calling and books appointments for you.

Great for agencies or IMOs managing multiple producers. - For budget-conscious agents:

Try a mix of aged leads from Lead Planet and a few real-time leads to balance volume and cost.

Or test CPL-based campaigns with Zenernet for flexible performance-based pricing. - Final thought:

There’s no one-size-fits-all answer. The best life insurance lead generation software is the one that fits your sales process, response time, and budget.

Speed, targeting, and consistency matter more than the logo on the dashboard.

Find insurance leads and contact lists

- Get Fresh Insurance Agents Email List 2025

- Email Extractor Ultimate Guide 2025

- Best Insurance Leads Companies in 2025

Explore more lead generation strategies and tools

- B2B Lead Generation Solutions – Guide for 2025

- How to Build a High-Quality B2B Email List for Outbound Marketing

- Buy Email Lists for Marketing in 2025: Complete Guide to Business Leads

- Why Scrape Google Maps? Use Cases for Sales, Marketing & SEO

- B2C Lead Generation: The 2025 Playbook

- 15 Best Lead Generation Companies for 2025

- Best B2B email list providers in 2025

- Top Lead Generation Agencies Compared (2025)

- 18 Best B2B Lead Generation softwares in 2025

- Lead Generation Guide: Strategies & Tools for 2025

Frequently Asked Questions

Life insurance leads are potential customers who’ve shown interest in purchasing a life insurance policy. These leads are typically generated through quote request forms, online ads, or outbound research. They include key contact details like name, phone number, email address, and sometimes product preferences or demographic filters such as age, income, or zip code.

Exclusive leads are sold to a single agent, giving you the best chance to close the sale without competition. Shared leads, on the other hand, are sold to multiple agents at once. While shared leads are more affordable, you’ll need to follow up quickly and be prepared to compete with other producers. Exclusive leads tend to convert better but come at a higher price.

Aged leads can absolutely be worth it — especially if you’re running your own outreach. These are leads that were generated days, weeks, or even months ago and are typically much cheaper than real-time leads. While they may require more effort to convert, they can help fill your pipeline affordably if you have a solid follow-up system in place.

The cost varies depending on the lead type. Shared web leads usually run between $15 and $35. Exclusive leads are more expensive, typically ranging from $40 to $70 or more. Live call transfers can cost $50 to $90 per call, while aged leads are much cheaper — often just $0.50 to $5 per lead depending on their age and source.

It depends on your budget, time, and skillset. Buying leads is faster and requires less setup, but you’ll pay more per lead and face more competition. If you’re comfortable with cold outreach or email marketing, generating your own leads with a tool like IGLeads can give you more control, better targeting, and long-term savings. Many top agents combine both methods to scale efficiently.