Best Insurance Leads Companies in 2025

You’re not alone. Whether selling auto, life, health, or business insurance, your success depends on reaching the right people at the right time. The question is, where do you find those people?

That’s where insurance leads come in. These are pre-qualified prospects already looking for coverage, delivered straight to you. Some are exclusive, some are shared, and some come in real time. Each option has its pros and cons, but what matters is this: are the leads accurate, fast, and targeted to your niche?

In this guide, we’ll compare the best insurance lead providers in 2025 and show you how to generate high-quality leads, even if you’re working with a tight budget. You will understand why we recommend using IGLeads’ lead scraping tool.

This guide will help you:

- Compare the top insurance lead providers in 2025

- Understand which is best for your niche

- Learn how to generate internet insurance leads on your own, using modern tools and methods (with or without paying for them)

Top Insurance Lead Companies in 2025

Tired of burning through your marketing budget on leads that go nowhere? You’re not alone.

The difference between struggling and thriving in insurance sales often comes down to the quality of your prospect pipeline.

We’ve spent months testing what the market offers, analyzing real conversion data, interviewing top-performing agents, and testing each lead provider’s promises. There is no marketing fluff, just results.

Our comprehensive evaluation focused on what actually impacts your bottom line: lead accuracy that prevents wasted follow-ups, precise targeting options that match your ideal customer profile, exclusivity arrangements that keep you from competing with five other agents for the same prospect, and pricing models flexible enough to scale with your business.

The results revealed clear winners that consistently deliver prospects ready to convert, not just quote shoppers. Here are the insurance lead providers worth your investment in 2025:

SmartFinancial

SmartFinancial has established itself as a versatile lead provider covering auto, home, health, and life insurance markets. The platform excels in delivering real-time leads through its sophisticated matching algorithm that connects consumers actively searching for insurance with appropriate agents.

Their exclusive lead options give agents the confidence that prospects aren’t simultaneously being contacted by multiple competitors. SmartFinancial’s flexible pricing structure allows agencies to scale their lead acquisition based on budget and capacity constraints.

While the service generally performs well nationwide, we noticed some inconsistency in lead quality across different geographic regions, with metropolitan areas typically yielding better results than rural markets. SmartFinancial is particularly valuable for agents who prioritize immediate lead access and want granular control over their targeting parameters.

NextGen Leads

NextGen Leads has carved out a specialized niche in the health and Medicare insurance sectors. Their strength lies in a transparent pay-per-lead model that eliminates subscription fees or long-term commitments.

The company’s proprietary technology ensures remarkably fast lead delivery, often connecting agents with prospects within minutes of initial interest. Their platform includes sophisticated A/B testing tools that continuously optimize ad performance to improve lead quality over time.

The primary limitation is NextGen’s narrow focus, making them less suitable for agencies seeking diversified insurance leads across multiple product categories. However, for brokers specializing in Medicare Advantage, Medicare Supplements, or ACA marketplace policies, NextGen Leads delivers consistent quality and volume that justify their premium pricing.

Datalot

Datalot differentiates itself through its live call transfer system for auto, health, and home insurance leads. Rather than simply providing contact information, Datalot qualifies prospects through an initial screening process and then transfers interested consumers directly to agents in real-time.

Their sophisticated call connection technology ensures smooth transitions between their call center representatives and insurance agents, creating a seamless experience for prospective clients. This approach significantly increases contact rates compared to traditional lead delivery methods.

The premium service comes with correspondingly higher costs per lead than email-based alternatives, but many agents report that the increased close rates justify the investment. Datalot is ideally suited for insurance professionals who excel at phone-based sales and prefer working with pre-qualified, ready-to-talk prospects.

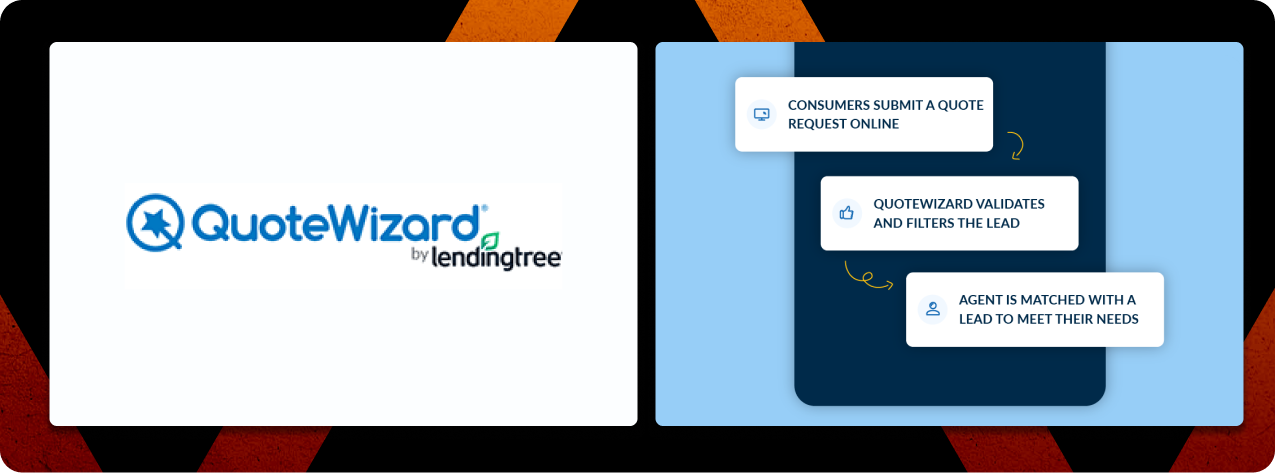

QuoteWizard

QuoteWizard remains one of the most recognized names in insurance lead generation, with particularly strong coverage in property and casualty lines like auto and homeowners insurance. Their extensive marketing reach generates substantial lead volume across all 50 states.

The platform offers highly customizable filters that allow agents to target specific demographics, coverage needs, and risk profiles. Their robust analytics dashboard provides valuable insights into lead performance and conversion trends.

One notable drawback is that standard leads are often shared with multiple agents unless you opt for their premium exclusive lead packages. Despite this limitation, QuoteWizard’s consistent lead quality and comprehensive geographic coverage make them an excellent choice for P&C agents looking to build a broad customer base.

Hometown Quotes

Hometown Quotes has built a sterling reputation in the life insurance and final expense market. Their focus on high-intent leads results in prospects who are genuinely interested in discussing coverage options rather than simply shopping for quotes.

Their warm transfer lead service connects agents directly with prospects who have explicitly requested information about life insurance or final expense policies. Each lead includes detailed notes from the initial qualification conversation, helping agents tailor their approach to the prospect’s specific situation.

While Hometown Quotes offers exceptional service for life insurance products, their coverage for other insurance types is limited. They’re the ideal partner for life insurance agents who value quality over quantity and focus on building personalized relationships with clients in the senior market.

EverQuote Pro

EverQuote Pro dominates the auto insurance lead space with unmatched volume capabilities. Their sophisticated routing system uses machine learning algorithms to match prospects with agents based on multiple compatibility factors, improving the likelihood of conversion.

Their platform offers real-time lead delivery with immediate notification options, ensuring agents can respond quickly to new opportunities. EverQuote’s scale allows them to generate leads across virtually every US market, making them suitable for both national carriers and independent agents.

The standard lead packages include shared leads, which means prospects may receive calls from multiple agents. Exclusive leads are available but come at a significant premium. Despite this drawback, EverQuote Pro remains the go-to solution for auto-focused agencies with efficient sales processes and strong close rates.

Lead Heroes

Lead Heroes has emerged as a valuable resource for agents targeting Medicare, final expense, and other senior market products. Their personalized approach to lead generation results in higher-quality prospects at more affordable price points than many larger competitors.

Unlike some providers that simply sell contact information, Lead Heroes equips agents with comprehensive resources including customized call scripts and follow-up templates designed to maximize conversion rates. Their exclusive lead options ensure agents won’t compete with others for the same prospects.

While they operate at a smaller scale than industry giants, many agents appreciate their attentive customer service and flexibility in customizing lead programs. Lead Heroes is particularly well-suited for independent agents and smaller agencies seeking cost-effective, exclusive leads in the senior insurance market.

How to Choose the Right Insurance Lead Provider

Not every provider will be a fit for your goals — here’s how to find the one that’s right for you:

Match by Niche

Start by narrowing providers based on the type of insurance you sell. For example:

- Selling Medicare? Try NextGen Leads or Lead Heroes

- Focused on auto? EverQuote Pro or QuoteWizard may be ideal

- Targeting life or final expense? Look at Hometown Quotes

Shared vs. Exclusive Leads

- Exclusive leads cost more but are only sold to one agent — giving you a better shot at conversion.

- Shared leads are cheaper but also more competitive. You may be racing other agents to contact the same person.

- Exclusive leads may be worth the investment if you’re a solo agent or new to sales. Shared leads can still

- deliver ROI if you have a solid follow-up process.

Budget and Volume

Larger agencies may be able to handle hundreds of leads per week, while smaller operations may need fewer, high-quality prospects. Be clear on your:

- Monthly budget

- Cost-per-lead (CPL) threshold

- Follow-up capacity

Some providers offer pay-per-lead plans or adjustable filters to help stay within budget.

Can You Get Insurance Leads Without Buying Them?

Absolutely. If you’re looking to reduce acquisition costs or build long-term momentum, there are several effective ways to generate internet insurance leads on your own.

Here are some proven lead generation strategies for insurance agents:

Content Marketing & SEO

Create helpful blog posts, videos, and landing pages around keywords like:

- “Best life insurance for young families”

- “Medicare explained for seniors”

- “How much auto insurance do I need?”

With time and consistency, organic traffic can become a steady source of leads—especially if you include lead forms or offer quotes directly on-site.

Local SEO & Google Business Profile

If you serve clients in a specific city or region, make sure your Google Business Profile is set up and optimized. Encourage happy clients to leave reviews and ensure your name, address, and phone number (NAP) is consistent across directories.

Local SEO helps you rank when people search for things like “auto insurance near me” or “best insurance agent in [city].”

Facebook Ads with Lead Forms

Meta’s lead ad format allows users to request a quote or consultation without ever leaving Facebook or Instagram. You can target by age, location, life events (like new parents or just married), or interests like “real estate” or “homeowners.”

Referral Partnerships

Partner with:

- Real estate agents

- Mortgage brokers

- Accountants or tax pros

These professionals often work with clients who need insurance, and referring each other’s services can generate qualified, trust-based leads.

LinkedIn Scraping (Tie-In with IGLeads)

LinkedIn is a goldmine for B2B-focused insurance agents (commercial insurance, group health, etc.). You can build hyper-specific lists of decision-makers based on industry, job title, or location, and that’s where IGLeads comes in.

IGLeads: An Alternative Way to Get Insurance Leads

Tired of overpaying for generic lead lists? IGLeads.io offers a modern, flexible, and affordable way to generate high-quality insurance leads on your terms.

How It Works:

- Use IGLeads to scrape LinkedIn, Google Maps, or Instagram

- Target specific groups like:

- Real estate agents (great for homeowners’ insurance)

- New parents (life insurance)

- Small business owners (commercial insurance)

- Filter by location, keywords, or industry

- Export your list with names, job titles, company names, and emails

- Reach out directly through email or LinkedIn with a personalized offer

Why It’s Different:

- Real-time data — no outdated databases

- You choose your niche, not limited to pre-set filters

- Affordable — plans starting at $29 with no contracts

- Perfect for small teams or solo agents who want full control

Compared to traditional lead providers, IGLeads gives you:

| IGLeads.io | Traditional Lead Vendors | |

| Real-time scraping | ✅ | ❌ |

| Custom targeting | ✅ | ❌ (limited categories) |

| Shared with other agents | ❌ | ✅ Often |

| Fixed monthly contracts | ❌ | ✅ Usually |

| Cost per 100 leads | Low | Medium–High |

This approach is ideal if you want to own your lead generation process instead of depending on third-party vendors.

Any Questions?

Yes, when they are high quality and aligned with your niche. The key is to track ROI and follow up quickly. Many agents succeed with exclusive or real-time leads, especially from platforms that match their target market.

Exclusive leads are sold only to you, increasing your chance of conversion. Shared leads are cheaper but may be sent to 3–5 agents simultaneously, increasing competition.

Use organic methods like content marketing, local SEO, referrals, and social media. You can also scrape LinkedIn contacts using tools like IGLeads to build targeted lists without paying per lead.

Yes. IGLeads is designed for non-technical users. You simply choose a platform (like LinkedIn), enter your search filters, and click “scrape.” You’ll get a CSV file with usable contacts; no coding or scraping knowledge is required.